Well put and good summary @Solvetheriddle, this is interesting.

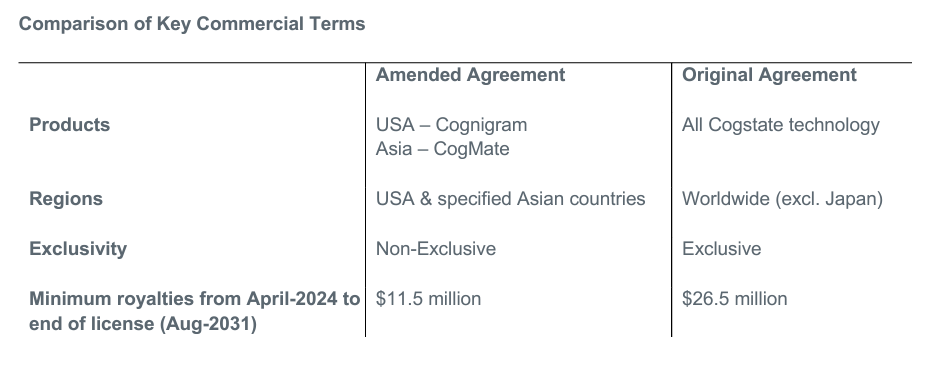

I'm on the bullish side of this; why would you forgo a guaranteed revenue stream if you didn't have something lined up on the side? Because I am a sucker for a sporting analogy, this is like an AFL player breaking their contract (with still a few years left on it) - they wouldn't do this unless they had been talking to other clubs, and exploring their options elsewhere, with possibly a verbal agreement or assurance of something a little sweeter?

Maybe this is what Brad was talking about in the SM Meeting back at the end of February? I'll need to go back and rewatch this meeting. Maybe with this announcement today it sheds more light on the meeting and some of what he was talking about regarding additional partnerships... In the announcement he's noted "...We are also eager to explore whether there is an extended role for Cogstate in the identification of patients that may benefit from new Alzheimer’s treatments.”

What I do like is that this provides CGS with rights for all intellectual property allowing them to pursue other growth initiatives.

What I don't like, (obviously) is the uncertainty that this brings to future revenue streams - which is why the market may have reacted negatively to this news this morning (down ~3-4%) at time of writing.

I was confused about CGS and their half yearly a month or so ago, you can find the write up here, along with some other very reasoned perspectives. I've been meaning to put in another straw following the meeting and provide some updates thoughts (now that I am less confused) since listening to Brad, I'll aim to do this once I get some free time.

Overall, I see this announcement as positive especially seeing as the Board continue to buy-back shares at current prices. Held IRL and SM, with potential to add at current levels once I reassess.

The below sums it up nicely if you ask me.