I’ve been trying to rack my brain as to where I heard about this company first… I’m 99% sure @Wini spoke about it on a podcast a while back (is this the case?), and that’s why I had it in my have a look list… I think.

Either way, I’ve been going over the company the last few days, and I’m impressed. This is a company that seems to have been chugging along nicely over the last few years.

What they do:

SKS Technologies Group is a company that delivers advanced technology solutions through digital transformation. They specialize in the creative design and installation of converged AV/IT, electrical, and communications networking solutions across Australia.

Their services include:

- Audiovisual: Display and projector systems, interactive whiteboards, specialist controlled lighting, public access systems, video and audio conferencing, touch panel control, and video walls.

- Communications: Voice and data structured cabling, optical fiber and copper, patch panel management, active equipment, cable networking auditing, and WAP installation.

- Electrical: General lighting and power, high voltage systems, earthing systems, uninterruptible power systems, and desktop power and data works.

- Maintenance/Essential Services: Light level audits, exit and emergency light tests, lamp replacements, test and tag electrical equipment, switchboard testing, and power analysis and data logging.

- Energy Management: Energy audits, energy savings timers and sensors, energy monitoring, power quality analysis, power factor correction, and lighting efficiency analysis.

- Smart Building Services: Converged networks and digital twins.

SKS Technologies Group serves a diverse range of sectors, including hospitals, aged care facilities, manufacturing, distribution, commercial buildings, correctional facilities, hotels, defence buildings, airports, data centres, retail centres, smart buildings, sporting complexes, universities, government, mining, resources, utilities, banks, and financial institution.

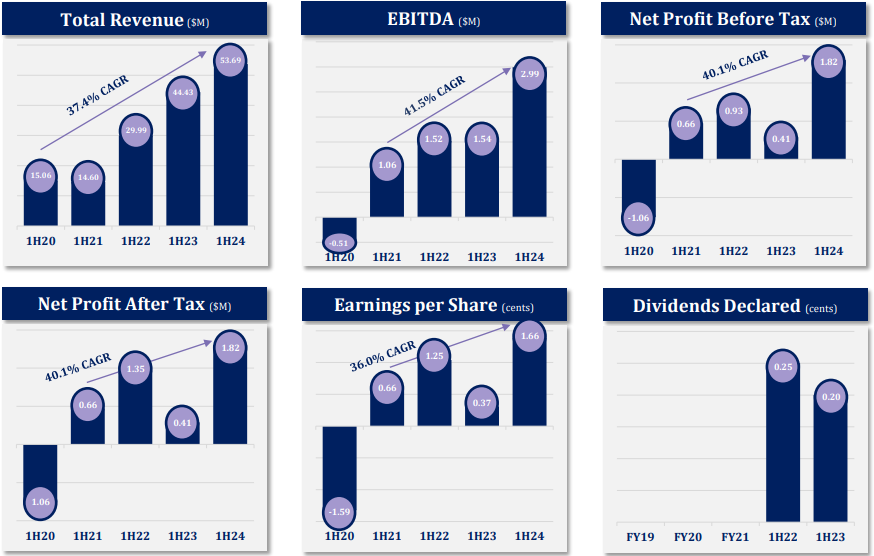

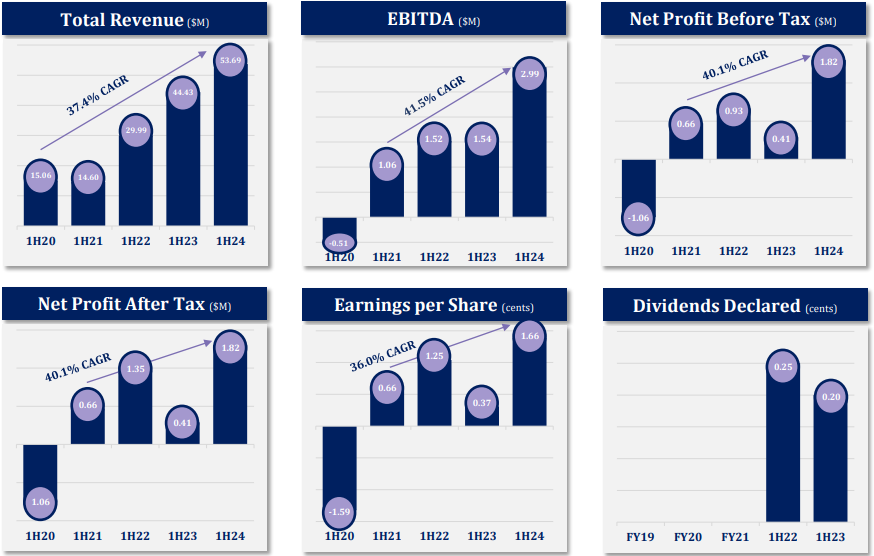

Impressive 1H 2024 Results: The following is derived from their 1H FY2024 Investor Presentation.

At first glance, the consistent growth the company has displayed over the last several years has been impressive.

SKS outline the following:

- "Earnings results reflect the considered decision to invest heavily for rapid expansion", and

- "Medium-term growth can now largely be achieved under the current cost base"

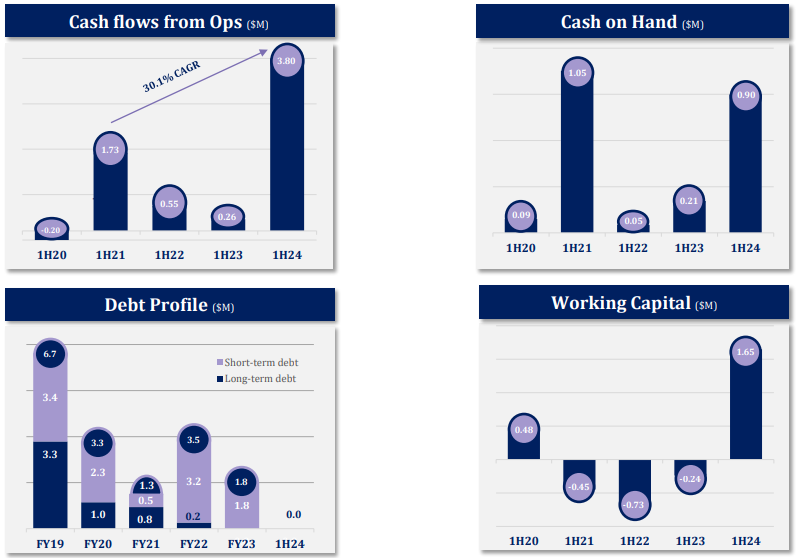

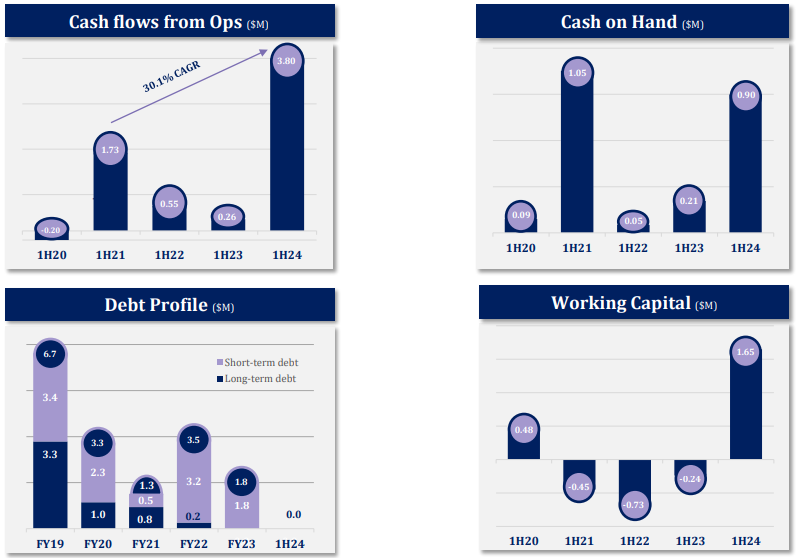

A relatively healthy balance sheet....

SKS outline the following:

- Turnaround in cash flows from operations between FY22 and FY23 enabled full retirement of R&D liability and a net reduction in short-term borrowings, which sits at 0 as at 1H24;

- The business now has no long term debt ;

- Short-term debt fluctuates according to sales and working capital required to fund projects, and is further augmented by the CBA overdraft;

- Increased CBA financing facilities from $8 million to $12 million in Nov 23:

- $3 million bank guarantee increased to $5 million

- An additional $2 million equipment financing facility

- Continuation of the $5 million overdraft

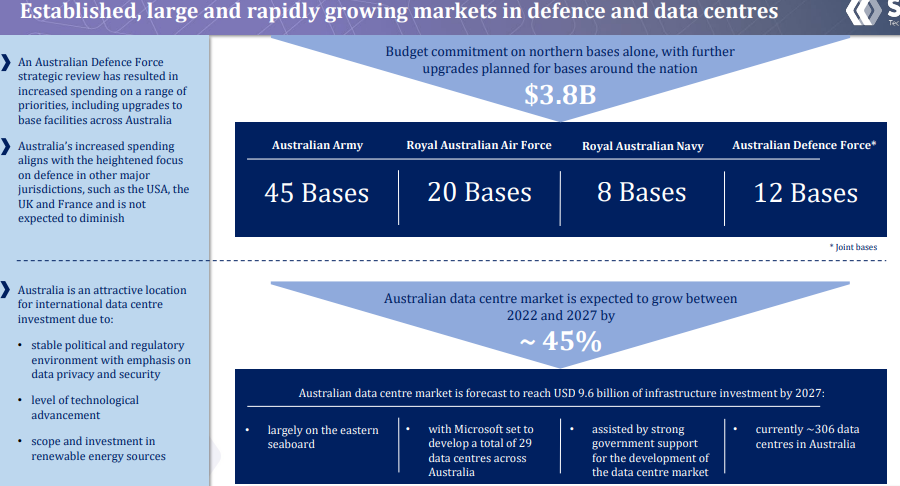

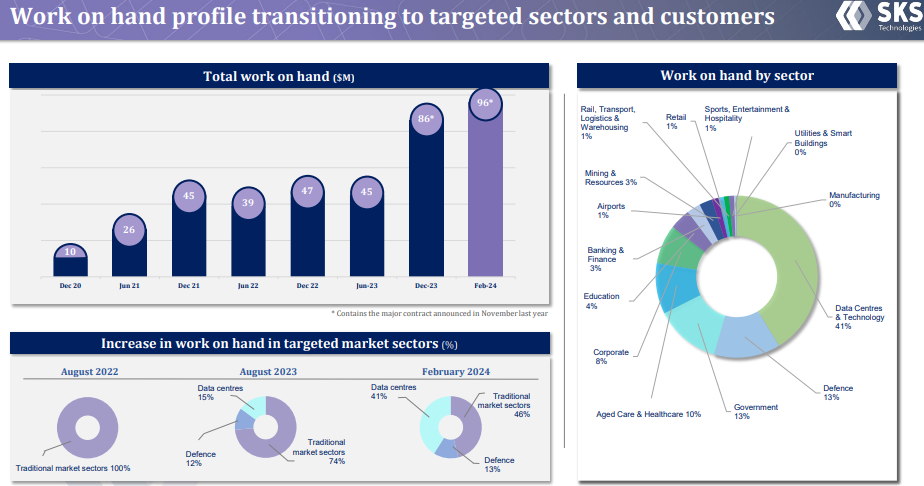

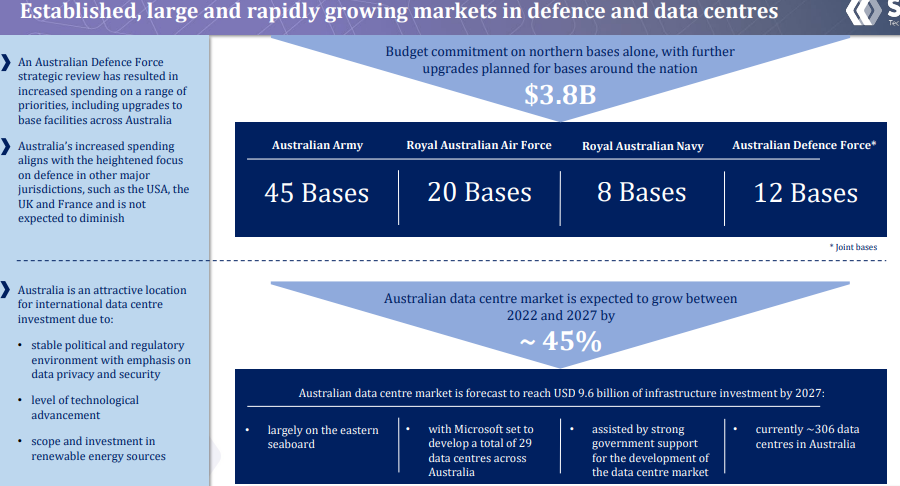

Over the last few years, SKS Technologies have begun to transition from their traditional market sectors as I outlined above, and into two (2) other sectors which can provide some impressive returns if they manage to get their piece of the pie, so to speak.

- Australian Defence Force, and;

- Data Centers.

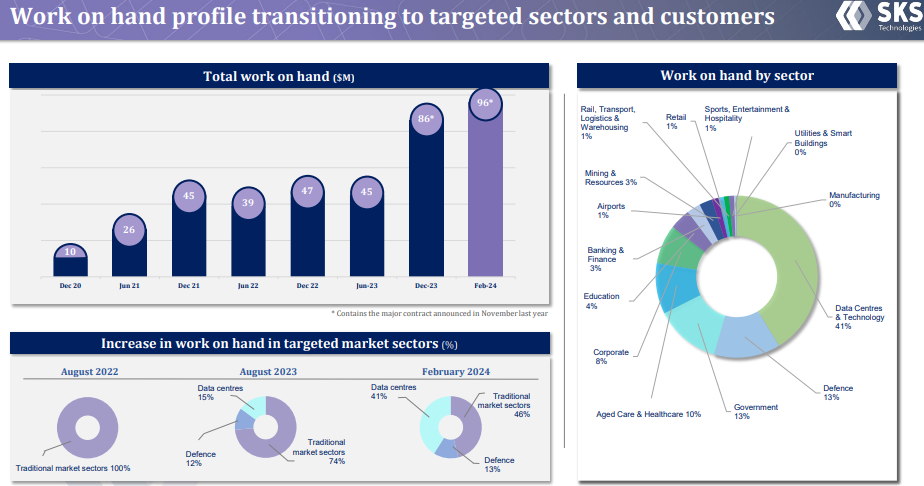

The following slide outlines the change in work since August 2022.

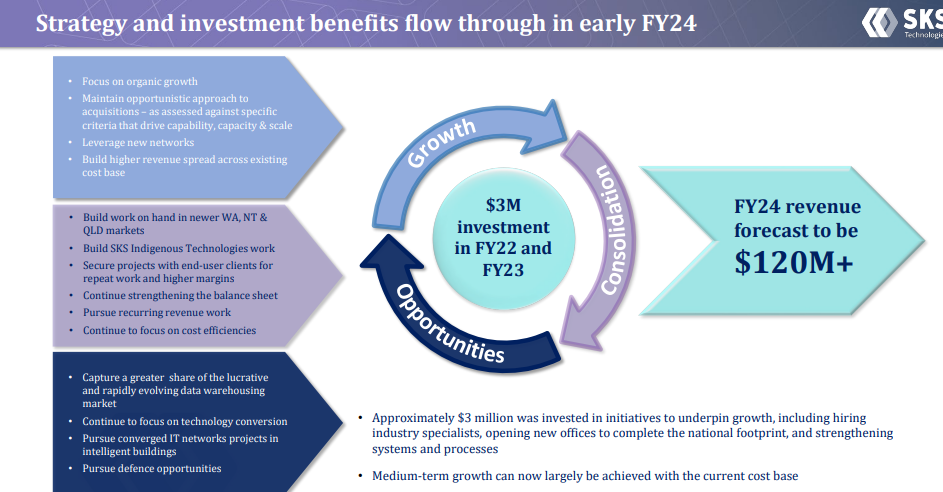

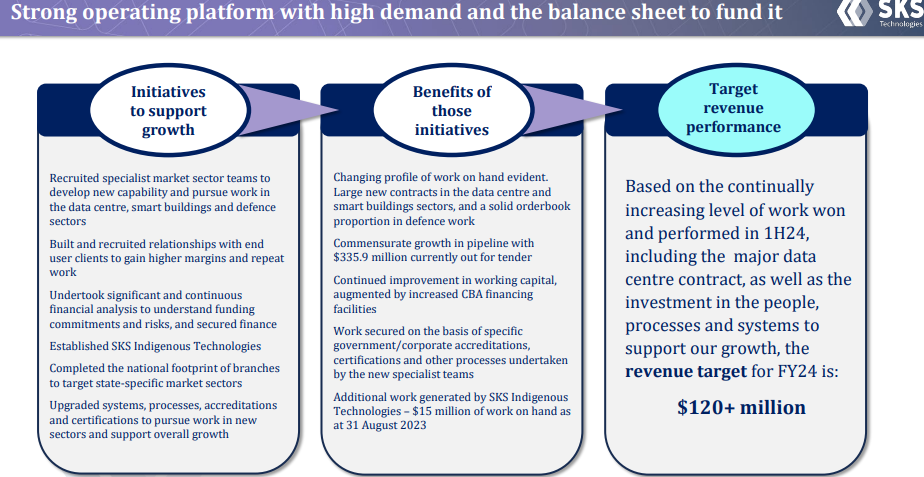

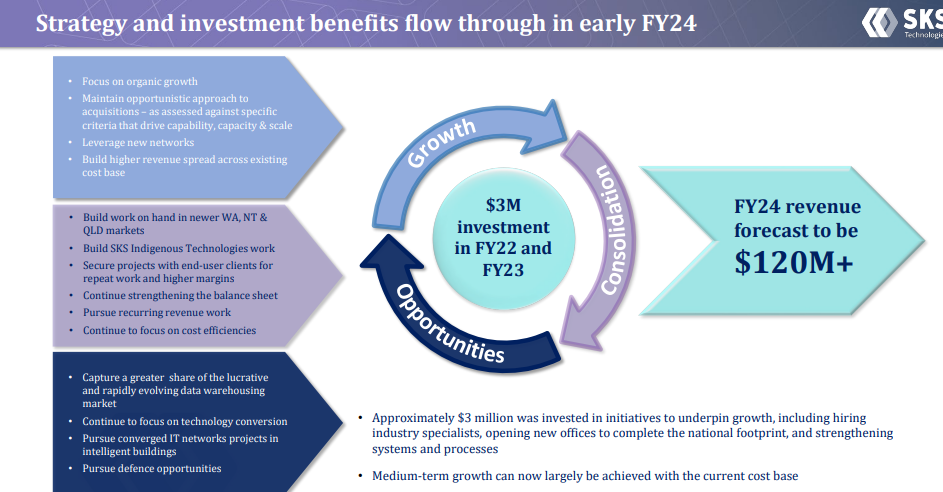

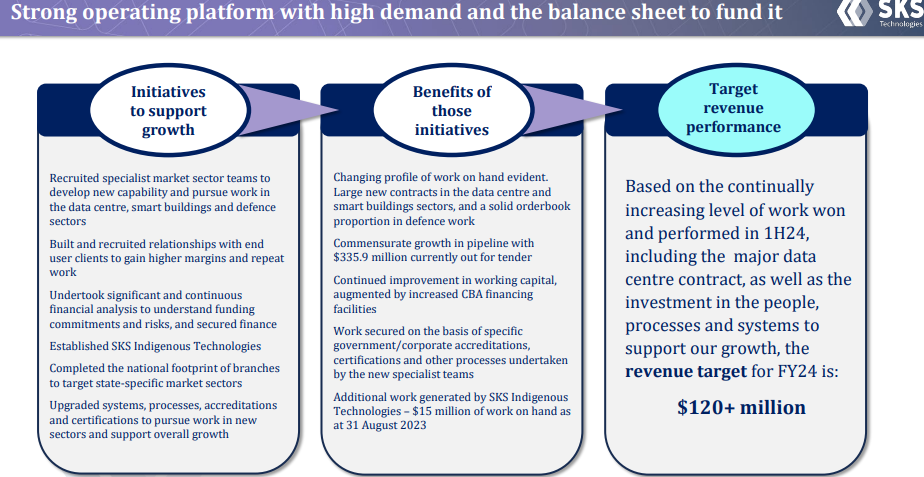

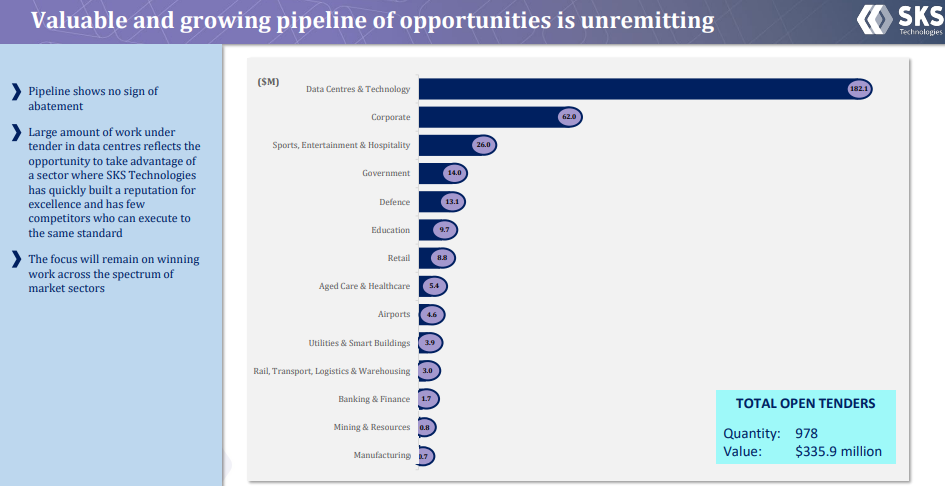

And finally, a pipeline of work and tenders with a forecasted revenue target of $120+ million for FY2024.

IF this revenue target is achieved, it would be a 40% revenue increase from $83 million in FY2023.

What I'm liking:

Consistent revenue growth.

SKS Technologies have a CAGR of 27% over the last five (5) years, from $25,173,473 in 2019 to $83,268,128 in 2023.

Within the annual report for 2023, SKS outlined expected revenue for FY2024 as between $90 - $100 million, which would have been anywhere from 10% - 20% of growth (which for the record, I would have still been relatively happy with)

As outlined above, SKS have now provided a revenue target of $120+ million. They have also outlined that medium-term growth can largely be achieved with the current cost base.

For me, the comment relating to cost base is an important one to make. I commonly see small companies increase their revenues however their cost base goes through the roof (ie: horray we increased revenue 50% to 10 million... but we also spat out 15 million in R&D and marketing)

Getting rid of their debt.

No long term debt and a reduction in short term borrowings.

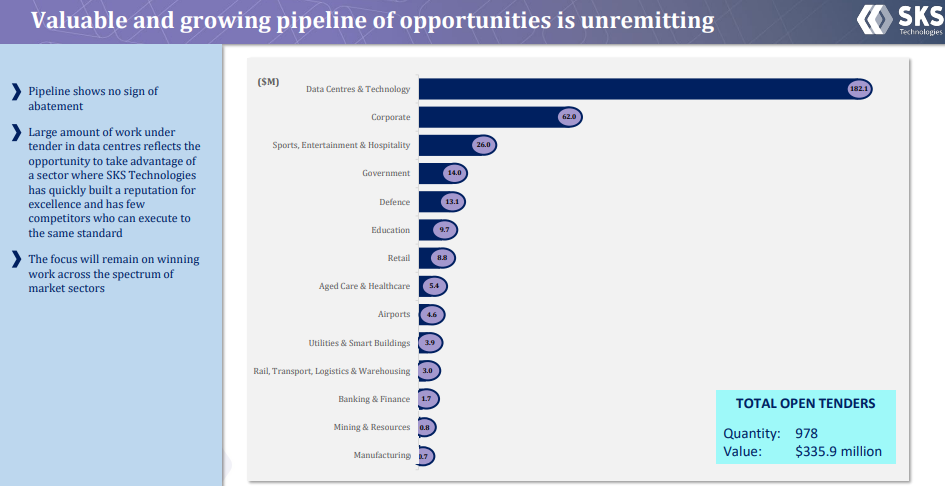

The work keeps coming in / Gaining market share.

SKS have managed to increase their total work on hand YoY for the last five years (5), essentially doubling work on hand YoY since 2020.

The defence sector is exciting for the company. As outlined, the budget for the northern bases is around $3.8 billion, with further upgrades expected around the country.

However, I am most excited about the possibilities related to data centers. The market for data centers / warehouses is growing rapidly, and if SKS are able to become known as one of the best in the business and capture the market share in this area, the growth prospects could be immense.

Cashflow.

Free cash flow positive and operating cash flow positive.. tick and tick.

In my humble opinion, this is a big hurdle point as in my eyes, this turns an unproven company into a proven company. Herein lies our edge as the small, private investor who manages to find these types of companies before institutional investors start to sniff around.

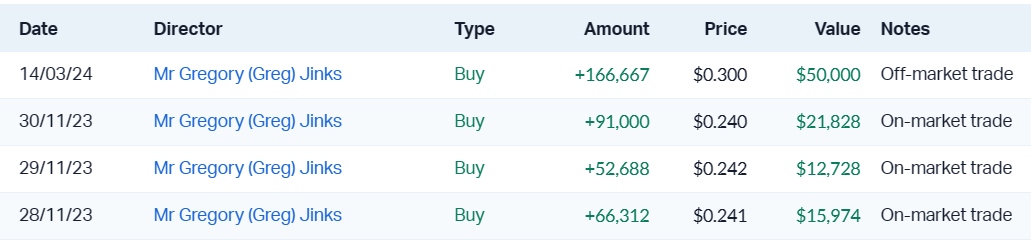

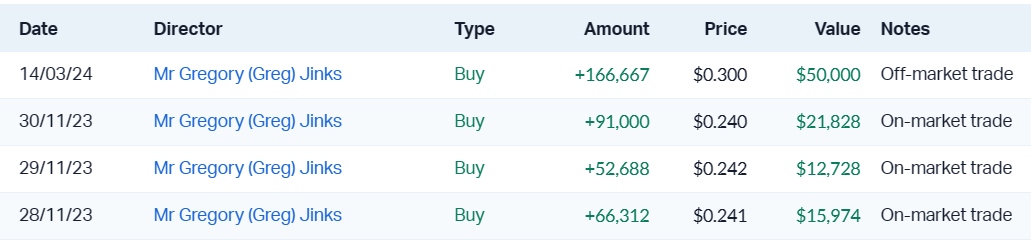

Insider ownership / Management

Greg Jinks - 15.70%, Peter Jinks - 9.23% and Matthew Jinks - 0.99% (inclusive of their related entities). This represents a total of 25.92% of total outstanding shares.

Peter Jinks - "Peter is Executive Chairman of the Company and has specific responsibility for operations and administration. Peter co-founded the KLM Group with Greg Jinks in 1981 and has been involved in the management of the business from its inception. He has over thirty plus years’ experience in technical services, specifically in electrical, data and communication consultation and management. Peter was crucial to the positioning of the KLM Group as one of Australia’s major communications and data network infrastructure contractors".

Greg Jinks - "Greg is Executive Director of the Company and has specific responsibility for strategy and business development. Greg was a cofounder of the KLM Group with Peter Jinks and was a key driver of a business that became one of Australia’s major communications and data network infrastructure contractors. Greg has more than twenty-five plus years’ experience in the telecommunications sector particularly in the area of cabling and infrastructure, voice and laser and microwave wireless products".

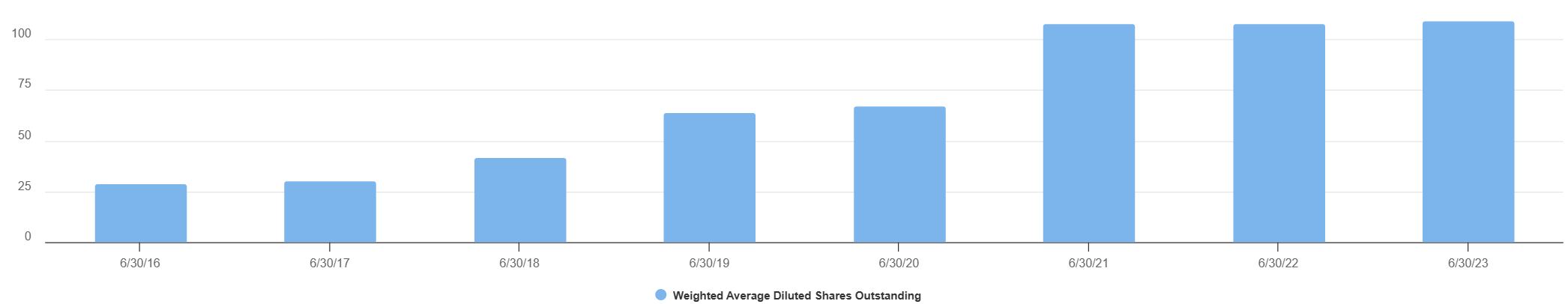

Image derived from Market Index.

What I'm not liking

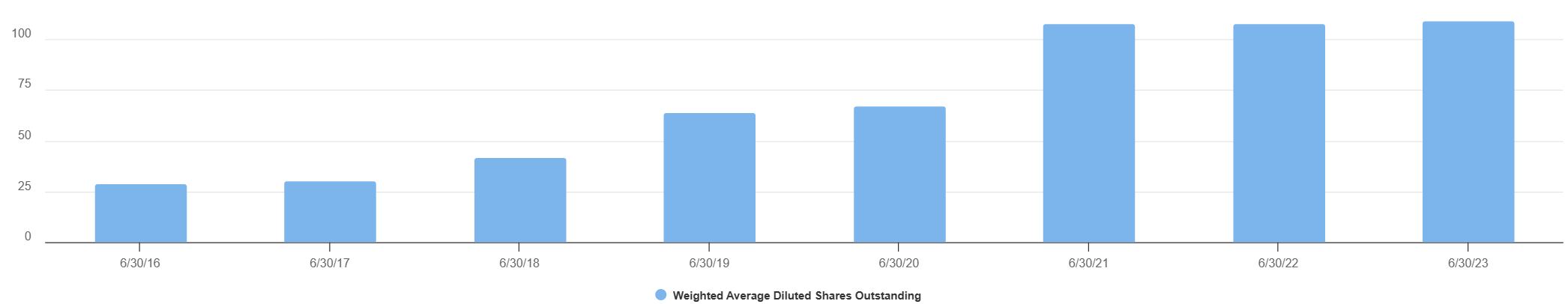

Capital Management.

This one is pretty minor. SKS have increased their shares from 29.15 million to where we are today at 109 million. Of note however, over the last three years, it has remained about level.

I don't mind seeing this increase, as long as they're using the money and getting return. Which, as of late, it looks like they are... so we can assume they've used the dilution smartly.

Valuation

I'll compile a more detailed valuation within the companies valuation section in the coming days...

I begun by looking at the valuation from a really simplistic viewpoint. Let's assume that management are on the mark and they hit the $120 million... Let's also assume that management are accurate and they maintain a similar cost base for the revenues.

These numbers would equate to NPAT of around $3.6 million. At the current share price of .40c, this would imply a PE ratio of 11x. Please, speak up if you think I'm wrong, but I don't see this company trading on PE multiple of 11.

Based on this fact... .40c is undervalued... but by how far is the question.

Disc: I've taken a position both in RL and on Strawman.