Bear77

17-April-2024: It's been a coupla weeks...

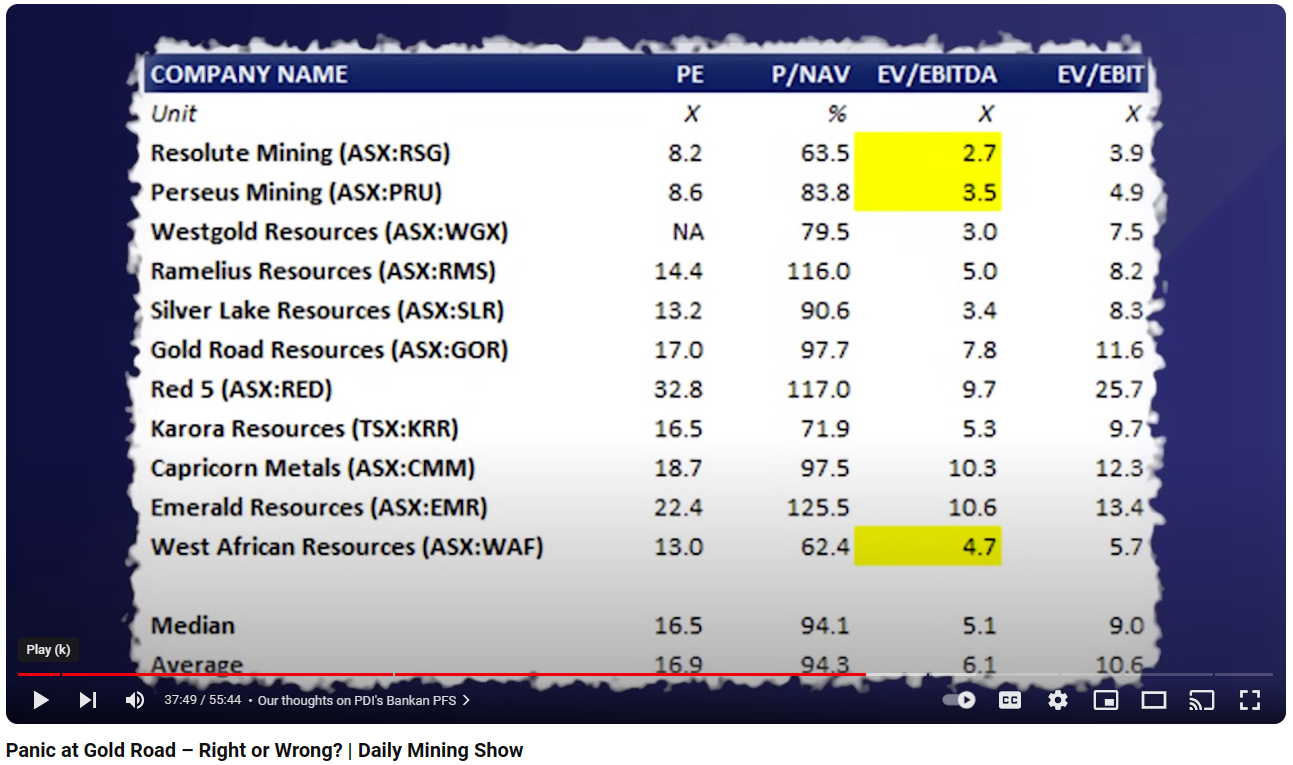

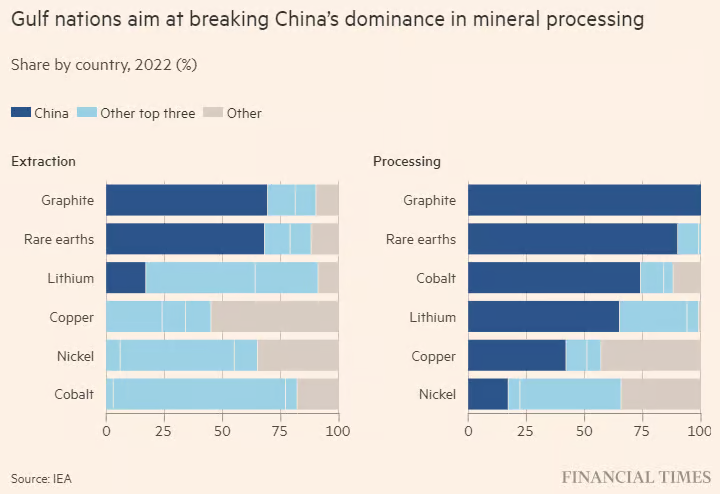

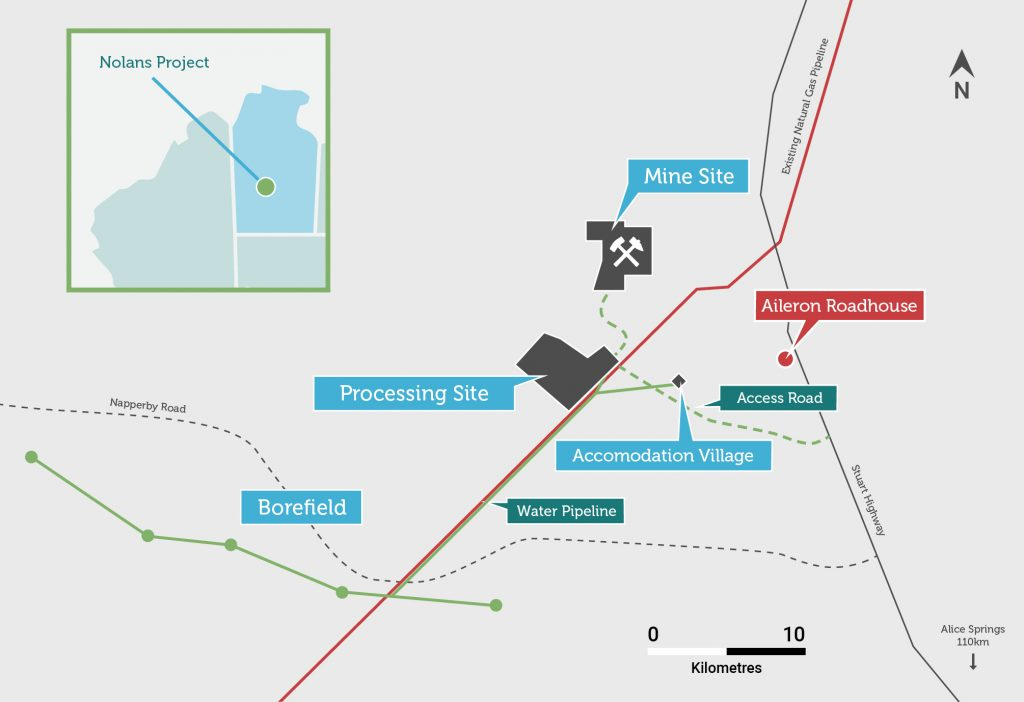

This table caught my attention in the Money of Mine's Monday (15th April 2024) podcast video which I was re-watching this afternoon:

Source: Panic at Gold Road – Right or Wrong? | Daily Mining Show (youtube.com) [15-April-2024]

Now at that point in the poddy, JD was discussing the discounts available in the West African focused gold miners listed on the ASX - so Australian-listed and Australian-HQ'd gold miners whose mines are all in West Africa - those three shaded yellow - and he included the others for comparison. And, to be honest, as I've mentioned in this thread before, they interest me not very much at all. However, the multiples that the OTHER gold companies are trading at, is what DOES interest me. I have been interested in (but not yet invested in) Westgold (WGX) but WGX's announcement last Monday (last week) of their planned merger with TSX-listed Karora (KRR.tsx) - after the Karora-Ramelius (RMS.asx) merger talks clearly broke down - has made me stay firmly on the sidelines for now - I'm always wary of being invested in the acquirer of a large asset unless I can see a lot of clear reasons why the acquisition makes sense - and I remain unconvinced in this case - so far.

Further Reading: A New 400kozpa Australian Gold Producer [08-April-2024] and Merger-to-Create-400-kozpa-Australian-Gold-Miner.PDF [08-April-2024] and...

Money of Mine Podcast 02-April-2024: Who's Karora's mystery partner ; and

Money of Mine Podcast 08-April-2024: Westgold revealed as Karora's partner

So, yeah, nah, not interested at this point. Let's wait and see how that one pans out. Of those goldies on that list above (in that table), I do hold EMR and CMM here on Strawman, but none of them in real money portfolios any longer, having previously held and now sold out of CMM, EMR, RMS and GOR (today - see here for why).

Those are a sort of Peer Group list for WGX and Karora that JD put together, and my real-money exposures in the sector are not on that list, being NST, GMD and BGL, plus some pick and shovel plays like GNG, LYL, NWH and XRF, and another company who has one division that is assisted by gold sentiment being positive, Codan (CDA). I also hold all of those here on SM as well as a little bit of KIN (a small gold explorer with a history of finding decent deposits and then selling them), a very speculative position in M2M (a gamble, not an investment) and a VERY small position in PNR, just to keep them on my radar because I have managed to make money trading them in prior years and likely will again at some point.

But my main exposures are NST and GMD (Northern Star Resources and Genesis Minerals, both held in my two largest real money portfolios) and, to a lesser extent, Bellevue Gold (BGL) which I hold in my SMSF.

I have posted straws or forum posts about a few other gold miners here lately:

- https://strawman.com/reports/SPR/Bear77?view-straw=25842 yesterday (16th April) on Spartan Resources (SPR) - formerly known as Gascoyne Resources - about their latest drilling results and their share price recovery over the past year;

- Updated my Emerald Resources (EMR) "valuation" (price target) here (5 days ago), and added an extra forum post on their Board and Management's backgrounds here (on Saturday - 4 days ago);

- Explained why I recently chose to exit (sell out of) Regis Resources (RRL) here;

- Updated my Capricorn Metals (CMM) price target six days ago here; and

- Also six days ago I added a straw titled "Onwards and Upwards" for Northern Star Resources (NST) that discusses their latest Operational Update (on 11-April-2024) and a little bit about why I like the company so much. Sometimes links to straws will take you to valuations instead, in which case just scroll down and the straw should be below the valuation.

So, yeah, I haven't been idle. Just not posting in this particular forum thread over the last couple of weeks.

BTW, I quit my afternoon shift job today, because the arthritis in my knees and hands has made the work too painful in the chilled food-prep environment (at the hommus and dips factory), so I may be spending even more time online, or not, we shall see. I certainly feel more positive in general about not having to go back there any more.

I wasn't planning to retire at 58, but it looks like I may have now. One thing I do know is that I will NOT get bored. Always plenty to do.

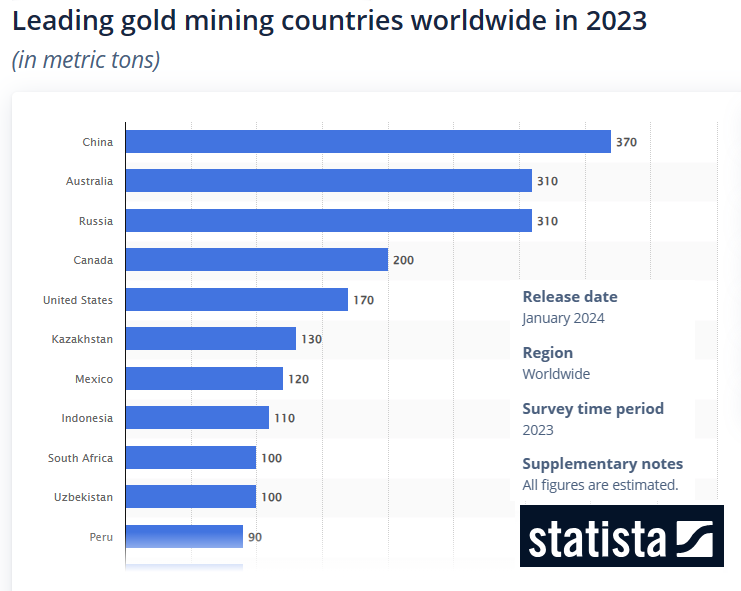

Here's another table I came across - not sure how accurate it is, but I imagine it's in the ball park:

Source: https://www.statista.com/statistics/264628/world-mine-production-of-gold/

The World Gold Council agrees that China produces more gold than Russia and Australia per year, but they put Russia ahead of Australia back in 2022:

Source: https://www.gold.org/goldhub/data/gold-production-by-country

Sources agree however that Australia either tied with Russia in 2023 or surpassed Russia and became the world's second largest gold producing country.

So now China, Australia, Russia, then Canada, then the USA.

And most western investors aren't looking to get exposure to gold through China, or Russia, so Australia and Canada are the premier stockmarkets for investors who want gold exposure through exposure to listed gold miners, so our Aussie gold miners are also looked at regularly and held often by international investors who want that exposure.

This applies particularly to our larger gold miners - like NST - which I do hold. Got to go cook some dinner for the fam' now. Ciao for now.

Bear77

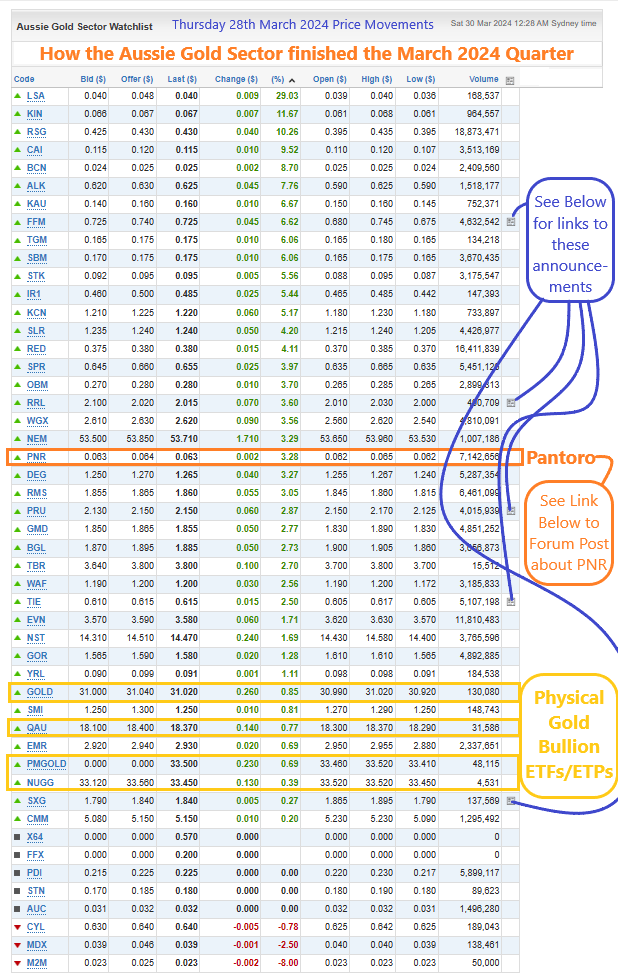

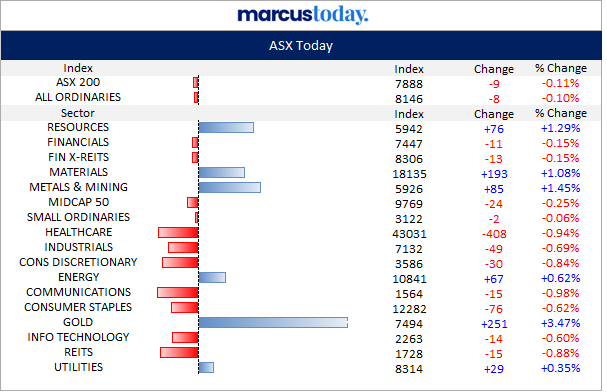

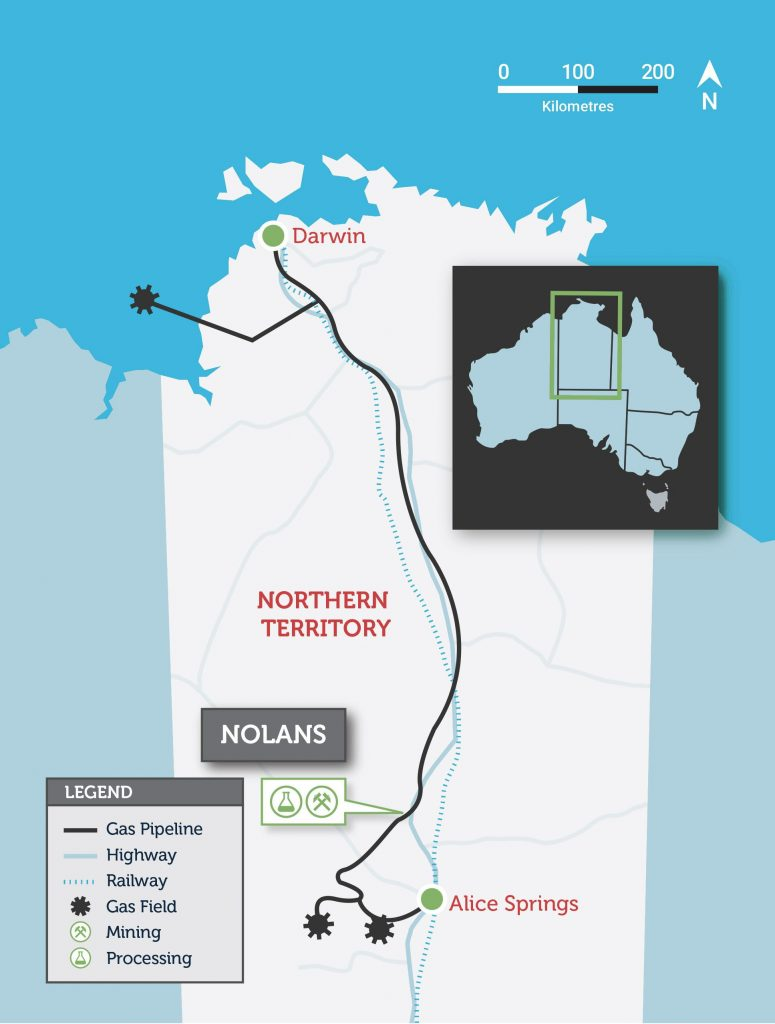

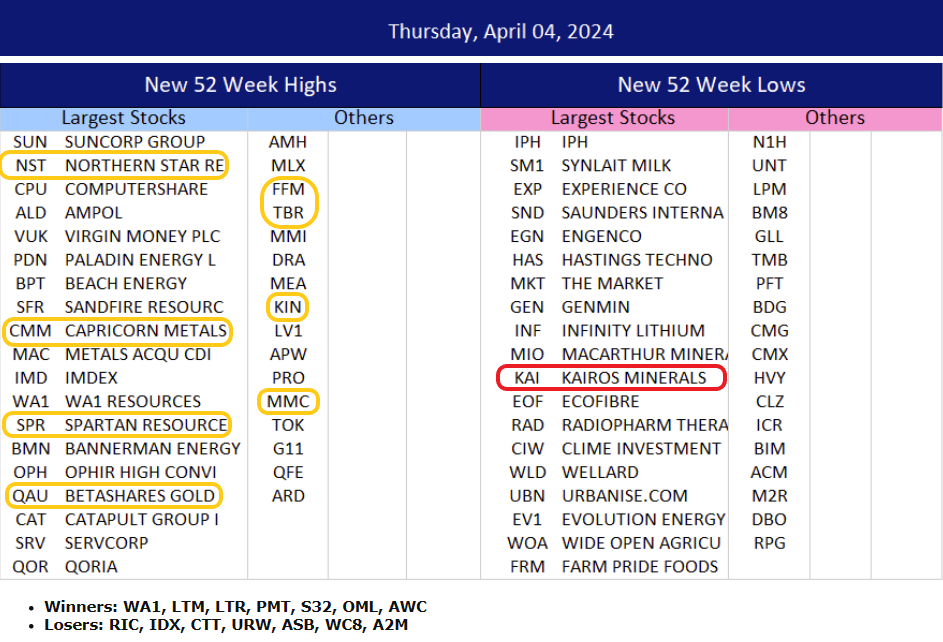

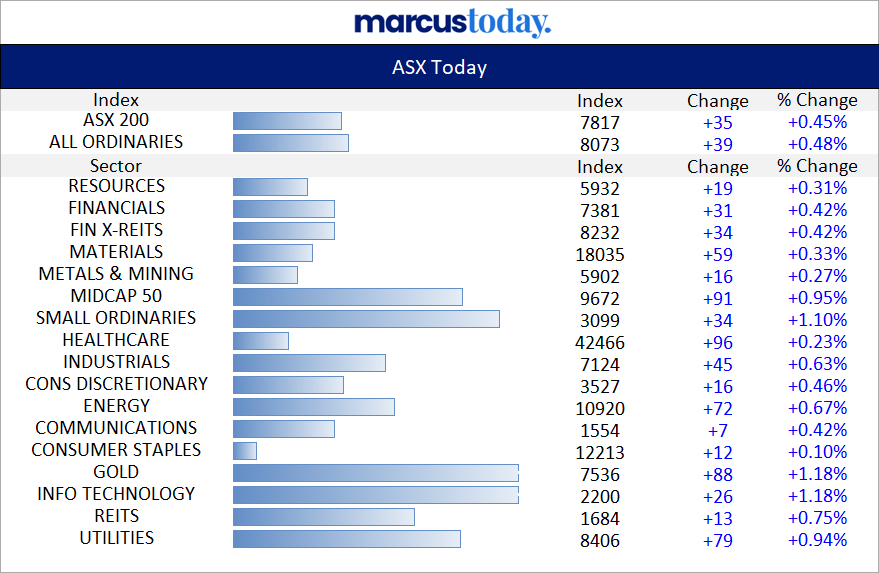

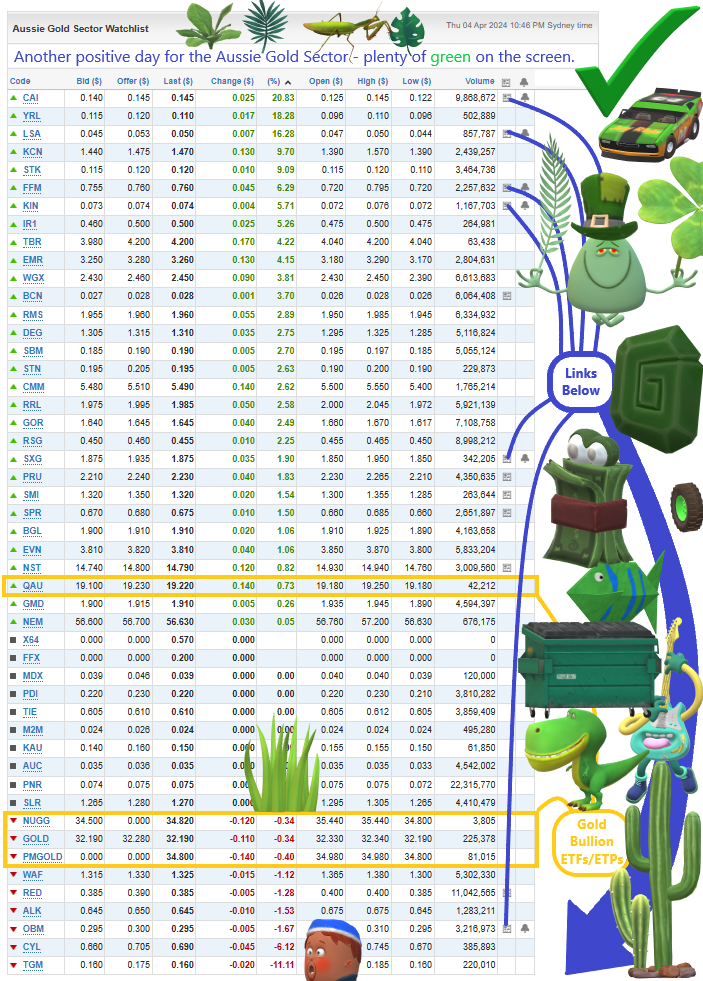

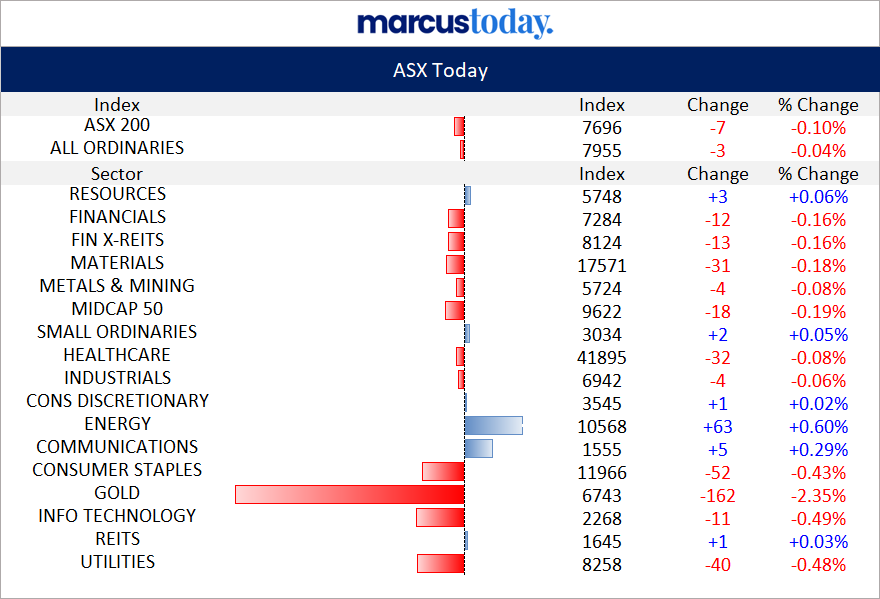

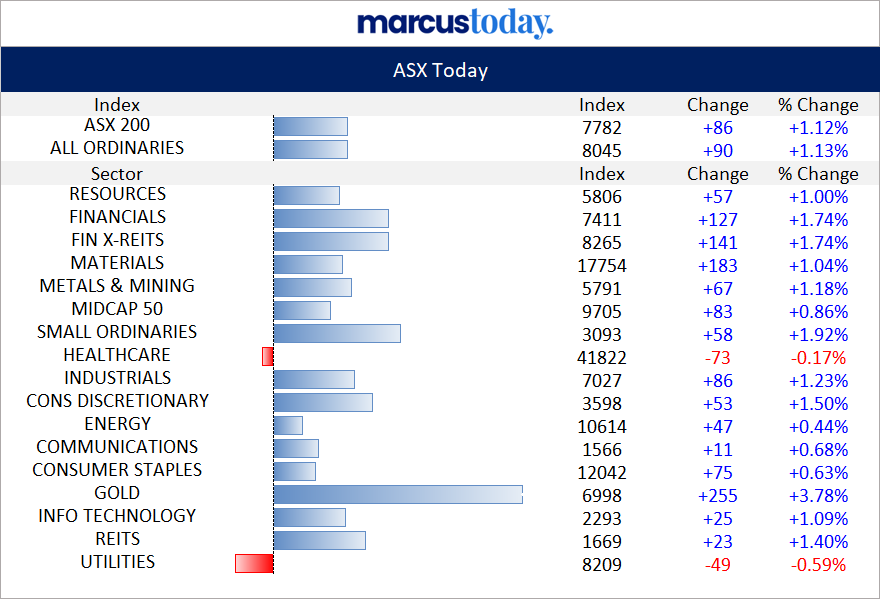

04-April-2024: Some in the Aussie Gold Sector are starting to move now:

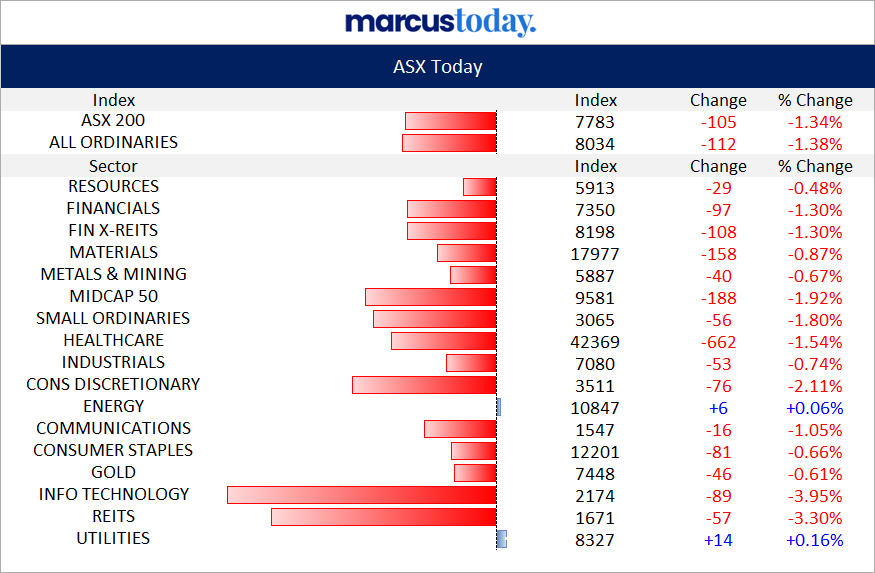

Not a bad day - but then... yesterday was 'orrible!

The Aussie Gold Sector did reasonably well on both days, all things considered, and today, the US$ gold price was down a little and the Aussie Gold Sector still outperformed:

Well, the vast majority did well anyway, not Catalyst Metals (CYL, -6.12%) and Theta Gold Mines (TGM, -11.11%). Theta Gold Mines is trying to get a mine started in South Africa, but they reported zero income (no production, so no sales) in the December quarter, so they're still at the cashburn stage.

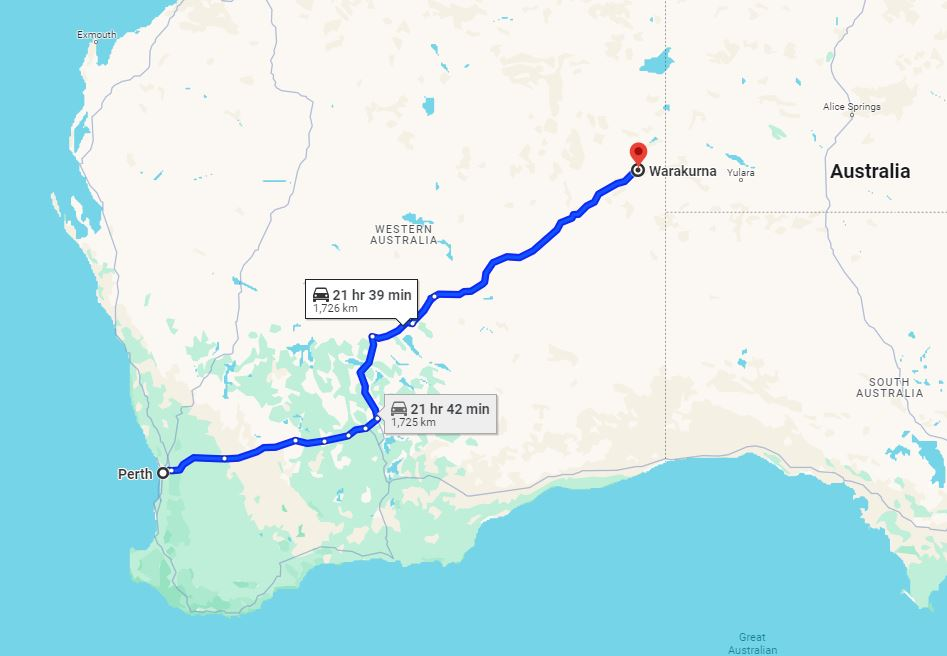

Catalyst Metals are in production at Henty, 23 kilometres from Queenstown in north western Tasmania, where their December quarter gold production was 5,306oz gold at an AISC of A$3,447/oz (Wow!!) and also at their Plutonic Gold Mine, 300 kilometres northeast of Meekatharra in the mid-west region of WA, where they reported 21,030oz gold sold at an AISC of A$2,713/oz in the December quarter (better, but not good). Catalyst's total gold sold for the quarter (across both mines) was 26,336oz at an average AISC of A$2,861. V. High Costs!

Source: https://catalystmetals.com.au/ and Quarterly-activities-report-Dec-2023-Qtr-CYL.PDF

See Also:

0:39:26 CYL's potentional working capital challenges [Money of Mine podcast - 02-Apr-2024]

Here's today's price-sensitive Announcements:

Calidus Resources (CAI):

Production-continues-upward-trend-at-Warrawoona.PDF

Resources Rising Stars Presentation.PDF [Presented at 11:30am (ACDT) today - Thursday 04-Apr-2024 - at the Resources Rising Stars (RSS) Gather Round 2024 being held in Adelaide, South Australia, to coincide with the AFL Footy Gather Round, also in Adelaide]

While CAI's SP rose +20.8% today, that was from a very low base, so they were up +2.5 cents to take them from 12 cps up to 14.5 cps, however they were trading at 29 cents/share (100% higher than their closing price today) a year ago on 12-Apr-2023.

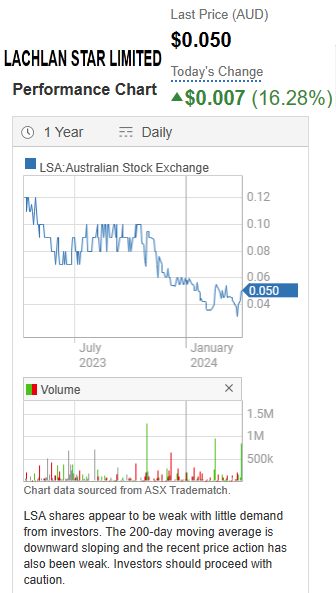

Lachlan Star (LSA):

MI6-Further-high-grade-copper-gold-intercepts-at-Moora.PDF

While LSA's SP rose +16.3% today from 4.3 cps to 5 cps, they were trading at the equivalent of 12 cps in April last year, so 140% higher than today's closing price. LSA did a 1-for-10 share consolidation in October, which they called a "reverse stock split", so when looking at their historical share prices (i.e. when they were 1.1 to 1.2 cents/share in April 2023), you have to multiply that by 10 to get the equivalent value to today's shares. For instance, if you held 100,000 LSA shares in April 2023 that were trading at 1.2cps, that would be worth $1,200, and now you would own 10,000 LSA shares (because of the 1-for-10 share consolidation or reverse stock split in October) trading at 5 cps, worth $500, so they were worth 140% more 12 months ago. On LSA's SP chart, the prices pre-share-consolidation have been automatically adjusted to reflect the proper value relative to the current share structure..

Here's the 12 month share price graphs of CAI and LSA, today's best two share price performers:

Source: Commsec.

FireFly Metals (FFM):

Investor Presentation April 2024 - Resources Rising Stars.PDF [Presented at the Resources Rising Stars Gather Round 2024 in Adelaide today - Thursday 04-Apr-2024]

FireFly Metals (FFM, formerly AuTeco Minerals) continued:

Response-to-ASX-Query-regarding-leaked-info-to-AFR-concerning-CR-(FFM).PDF

Further Reading: Canadian gold play FireFly in $52m cash call (afr.com) [26-March-2024, this is the AFR article that the ASX sent FFM the Query Letter about - see previous link]

FFM hit an intraday 12-month high of 79.5 cps today, before closing at 76 cps, up +6.3% for the day.

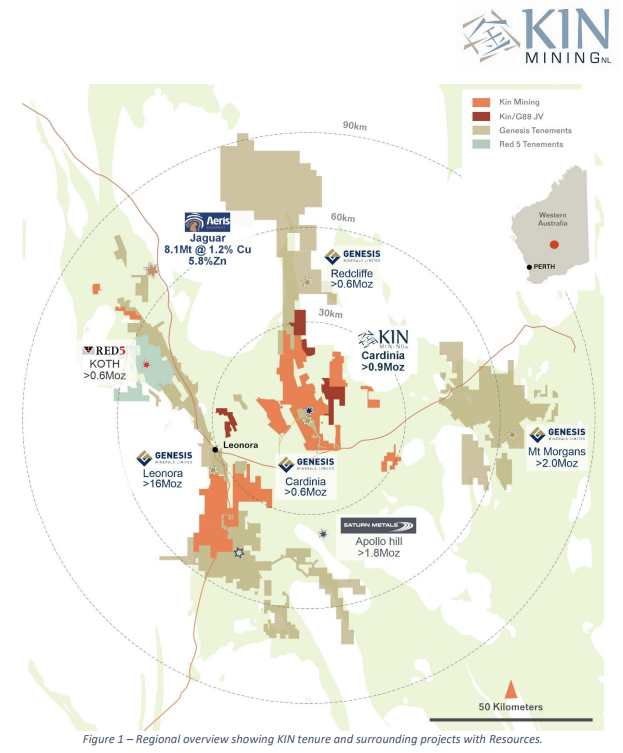

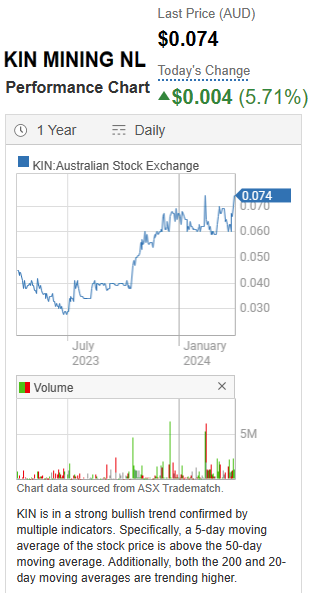

Kin Mining (KIN):

RRS-Gather-Round-Presentation---4-April-2024(KIN).PDF

Also, yesterday (03-Apr-2024): Kin-to-Accelerate-Cardinia-Base-Metal-and-Gold-Exploration.PDF

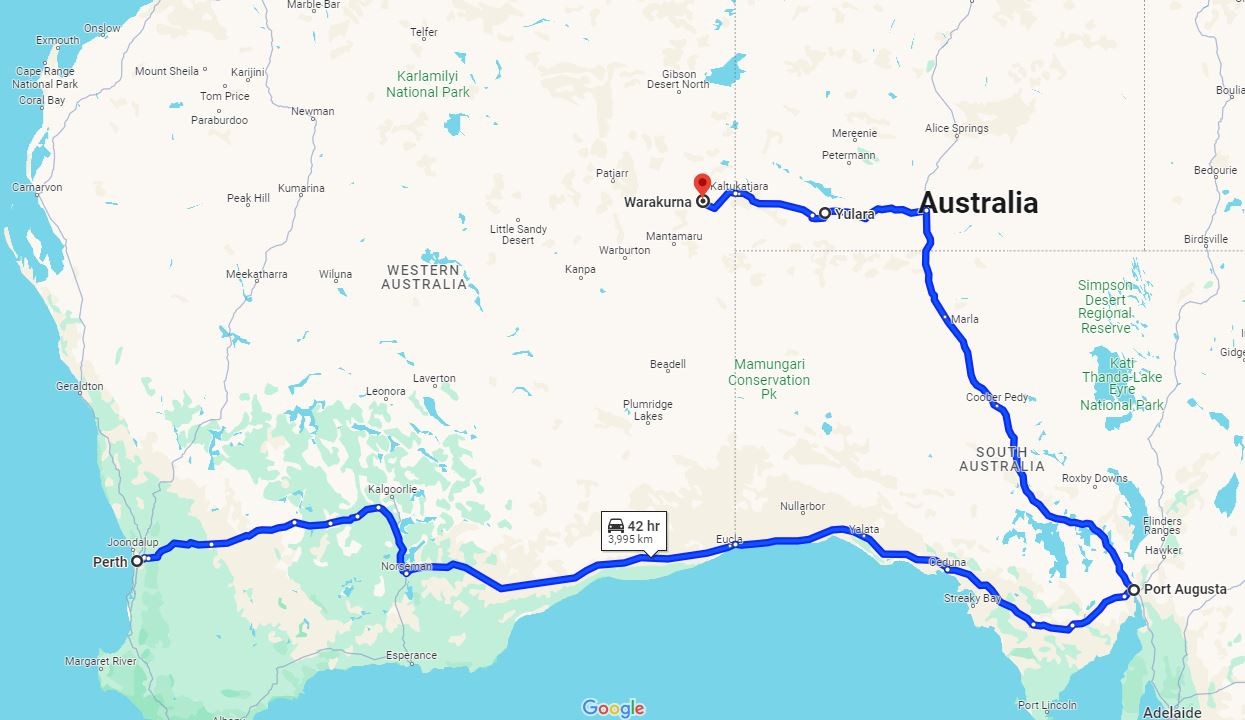

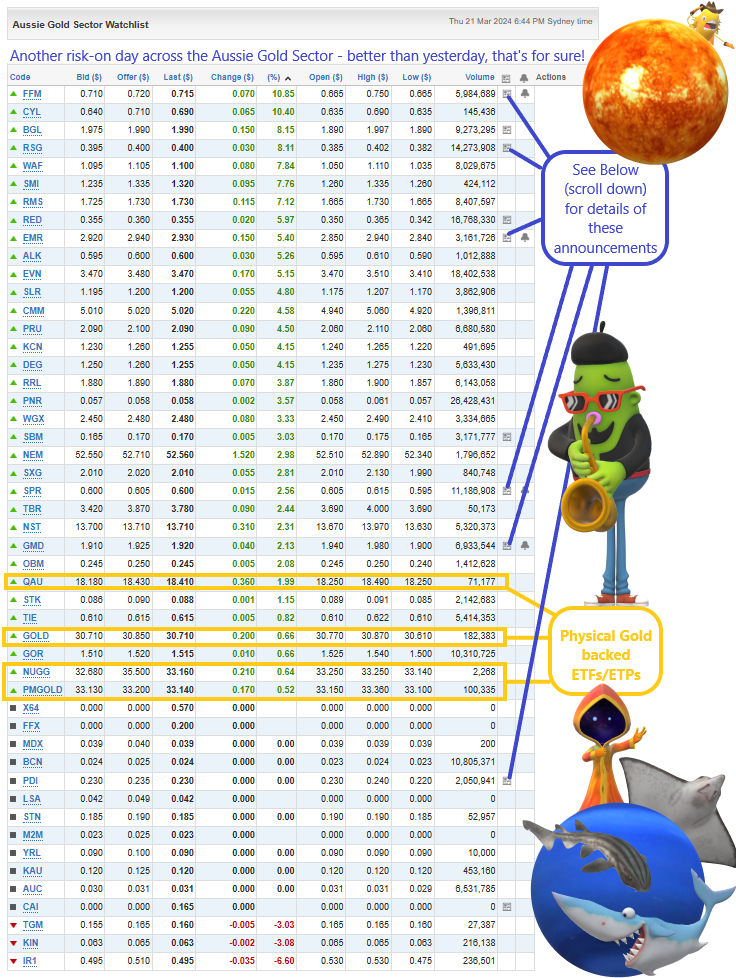

KIN is keen to show that their Cardinia project is surrounded by Genesis Minerals (GMD) assets, however it pays to note that Genesis bought everything they wanted that KIN owned at the time (Bruno-Lewis and Raeside) from KIN as announced in December (see here: Genesis to acquire two WA gold tenements from Kin Mining (mining-technology.com) [14-Dec-2023]) and that was all settled in early February, and what KIN are left with is what Genesis did not want. The market seems to have forgotten that, and KIN seem to be getting bid up as a nearology play or an M&A target.

KIN's SP was up +6% on Wednesday then another +5.7% on Thursday, so from 6.6 cps to 7.4 cps in two days (+12%), and they tagged 7.6 cps today (Thursday) which was a 12-month high for them. I added them to my Strawman.com portfolio here last week (March 26th) at 6.3 cps and they're up almost +17.5% in 9 days. I'll probably flip them soon, they're a trade, not an investment, for me anyway. I figured they might get even more self-promotional and with the gold price doing so well lately, it seemed like a good idea at the time. KIN are unlikely to use this 12-month high SP as the catalyst for a CR, because they're already cashed up from the recent asset sales to Genesis. But you never know...

Source: Commsec.

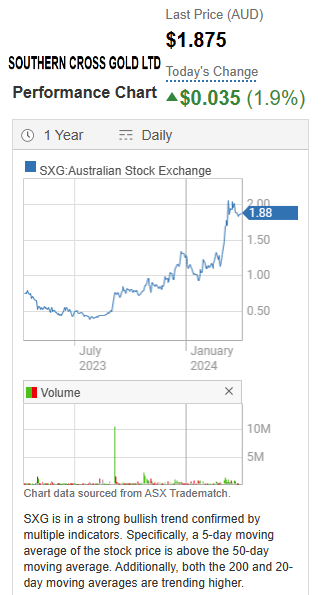

Southern Cross Gold (SXG):

SXG-Announces-$1023-million-Fully-Underwritten-Rights-Issue.PDF

Non-Renounceable-Rights-Issue-Offer-Booklet(SXG).PDF

Good time to do a CR... and they did!

Good time to do a CR... and they did!

Chart Data Source: Commsec.

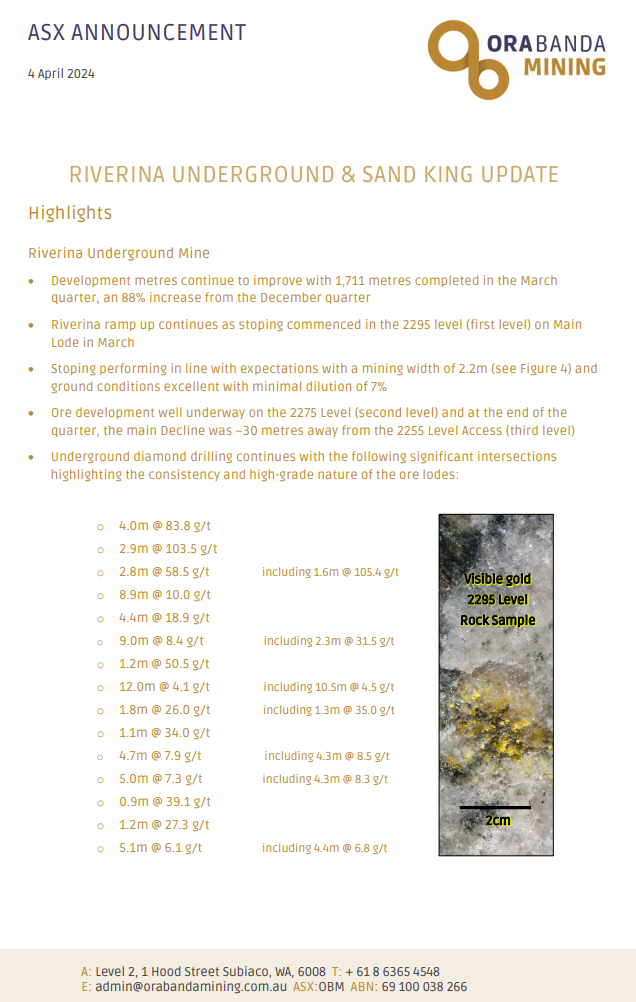

Ora Banda Mining (OBM):

Riverina and Sand King Update.PDF

Some reasonable gold grades there for OBM - and they've managed to quietly get their market cap up to $553 million now, so they're no so tiny any more.

--- end of announcements ---

Best MoM poddy this week (so far):

Compare the Pair: Westgold vs Ramelius | Daily Mining Show - YouTube Apr 3, 2024 Daily Mining Show

"Quarterly season has begun! We kick off with diverging reports from Westgold (WGX) and Ramelius (RMS) then move onto Regis (RRL) which disappointed with updated figures from McPhillamy’s."

"Next up we chatted about some speculation from the Director’s Special which is looking on the money, before touching on a slight of hand at Boss Energy (BOE)."

"Our penultimate story was on Develop (DVP) who share revised figures for Woodlawn and lastly we spoke about one of the ASX’s most intriguing companies, ERA."

CHAPTERS

0:00:00 Introduction

0:02:40 Compare the pair! WGX v RMS

0:10:00 Regis disappoints with McPhillamy's numbers

0:25:30 M&A speculation looks on the money

0:30:05 Boss Energy delays first U

0:34:47 Develop dials up metals prices at Woodlawn

0:42:21 One of the ASX's most intriguing co's: ERA

-------------------------------

DISCLAIMER

All Money of Mine episodes are for informational purposes only and may contain forward-looking statements that may not eventuate. The co-hosts are not financial advisers and any views expressed are their opinion only. Please do your own research before making any investment decision or alternatively seek advice from a registered financial professional.

Bear77

28-March-2024: https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset

The case for a strategic allocation to gold | World Gold Council

2024 Edition.

Strategic-case-for-gold-2024.pdf

OK, so I prefer to have my exposure to gold through holding shares in companies that own a lot of gold, most of it still underground or in ore stockpiles waiting to be processed.

And I try to be quite picky and choosy about which of the many Aussie Gold sector companies I invest in.

As noted here recently, there has been a LARGE disconnect between the rising gold price and the global gold sector, and particularly the Aussie gold sector, and that is very evident when you look at the following:

Source: https://goldprice.org/ at 12:30am on Saturday 30th March 2024.

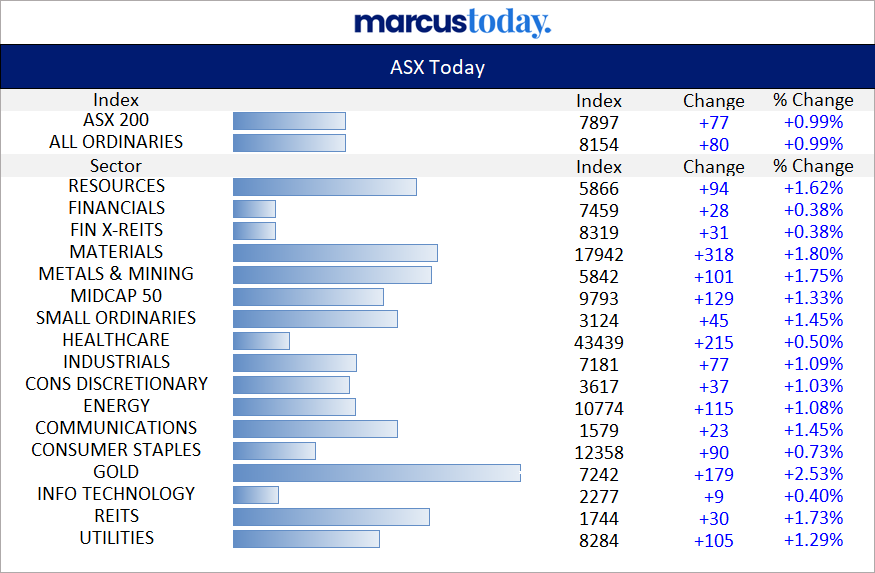

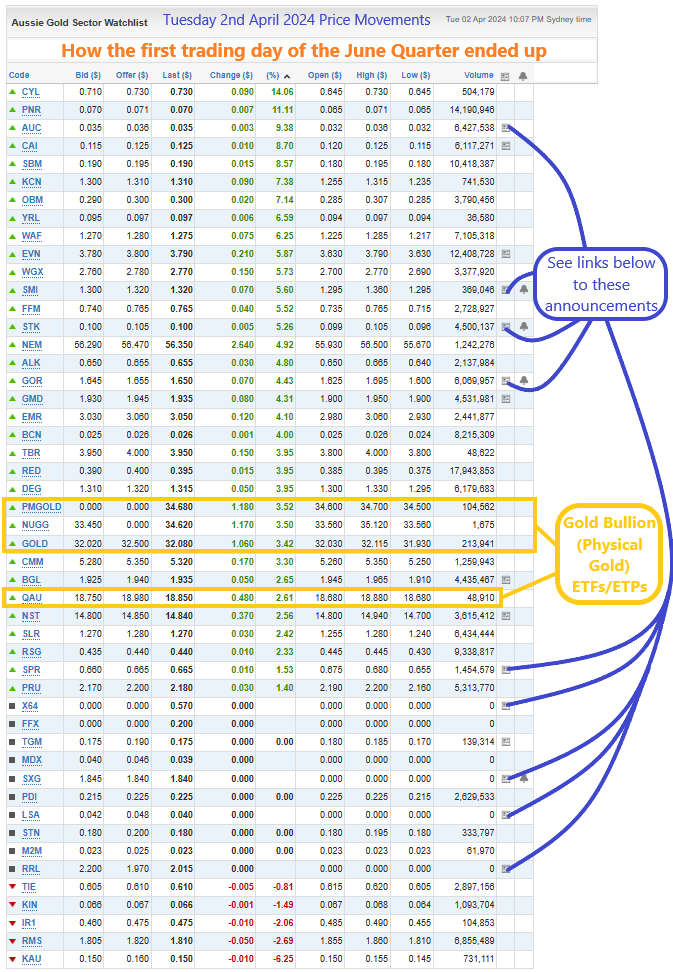

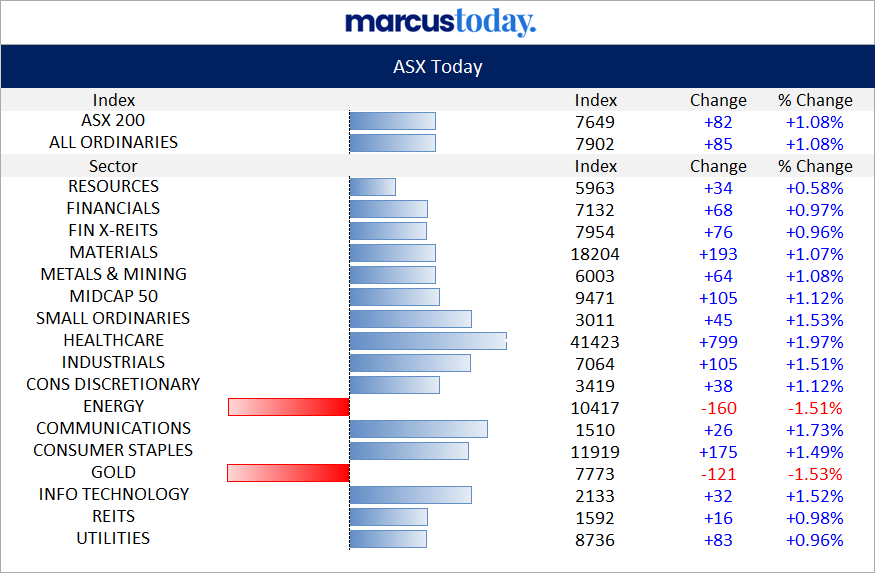

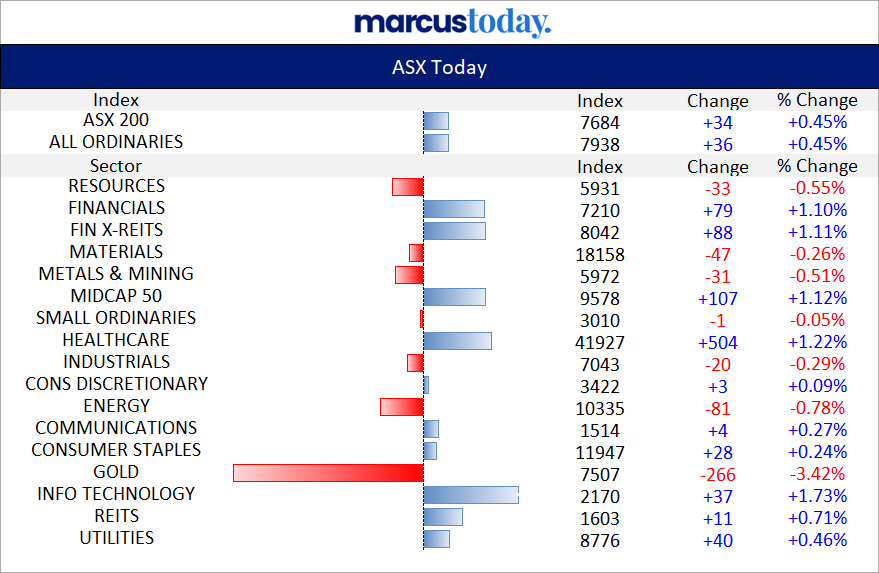

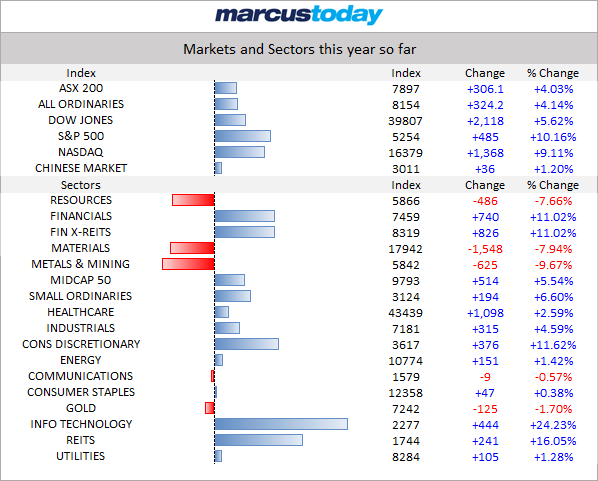

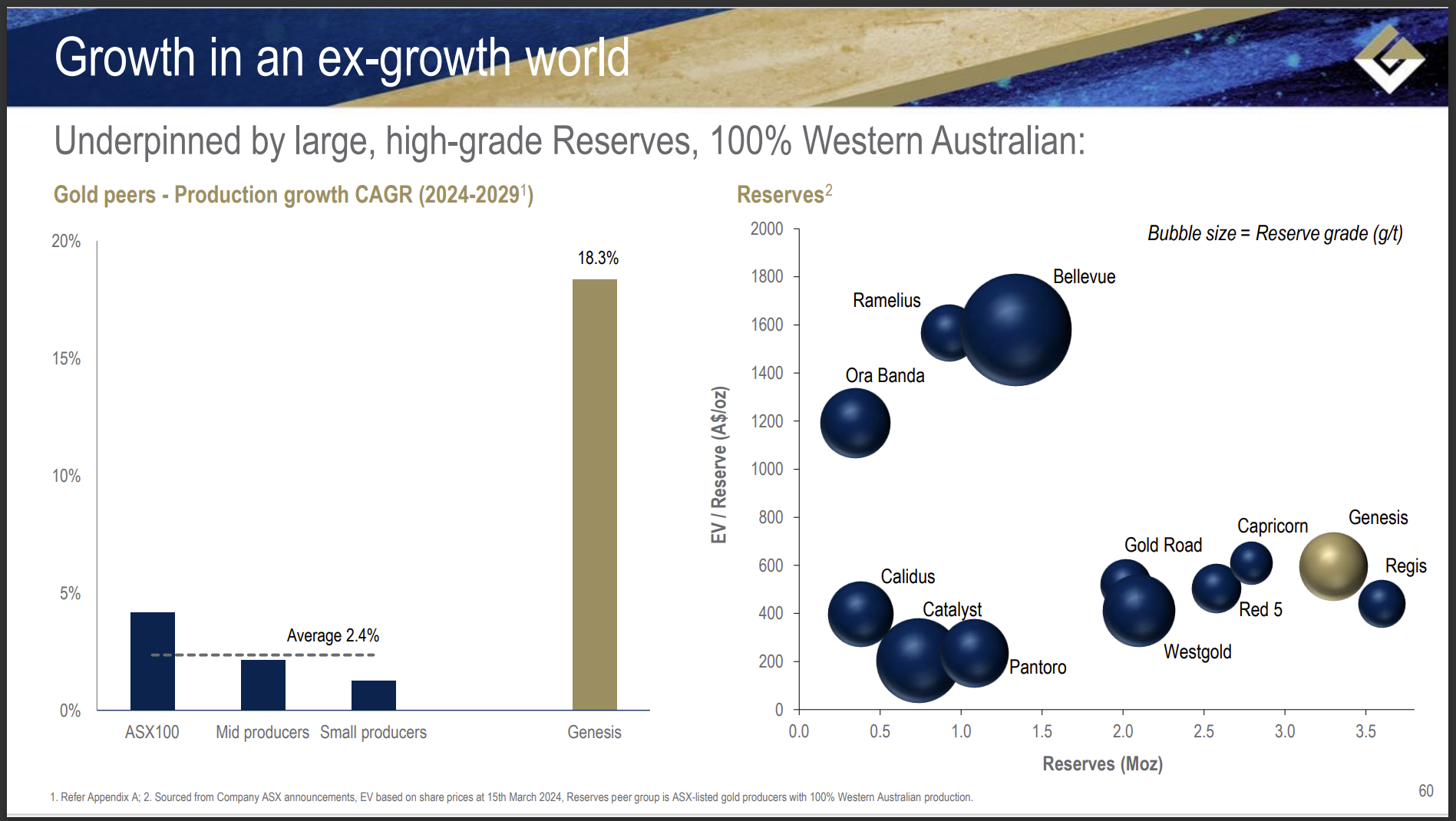

And this table below of YTD (year to date) movements in the markets and Aussie sectors in 2024:

Source: MarcusToday's Saturday ("Marcus Morning Lite") newsletter, usually sent out on Saturdays, but sent out on Friday this week because of the Good Friday public holiday.

Apart from a slight decline in the Telco/Comms sector, the sectors that are still in the red are Resources, Materials, Metals & Mining, and Gold, albeit Gold has performed better than other mining sectors but it's still gone backwards in the first three months of 2024, while the underlying gold price has gone sharply upwards (as shown on the gold price chart above).

Two ways to view that (at least); you can conclude that these red sectors are just foolish places to invest because the returns are going to be sub-par and you're more likely to lose money than make money, or... you could conclude that a positive re-rate might be overdue in those sectors, such as gold, where the underlying commodity price is rising sharply, and has been rising at a good clip for months. I'm leaning towards the second school of thought there, as you might expect; I am, after all, a "goldbug", so take all of this (except the graphs and tables which display factual and correct data) with a grain or three of salt, but I'm thinking that if you get the stockpicking part right (and that's no easy task!) then a decent allocation to some of these better quality underperforming gold producers might prove in time to be a beneficial investment choice. That's my story anyway, and I'm sticking to it!

Bear77

Thursday 21st March 2024: The Aussie gold sector rollercoaster continues:

Down Yesterday:

Up Today:

The overall trend is up for a good number of these goldies however:

Announcements:

FireFly Metals (FFM, formerly AuTeco Minerals):

More-wide-zones-grading-4-Copper-at-Green-Bay-Project.PDF [21-Mar-2024]

Also, recently: Board-Changes.PDF [19-Mar-2024]

Resolute Mining (RSG):

Director-Changes.PDF [21-Mar-2024]

Emerald Resources (EMR):

Third-Supplementary-Bidder's-Statement.PDF [20-Mar-2024, 7:16pm]

Spartan Resources (SPR, formerly Gascoyne Resources):

Response-to-ASX-Query-(SPR).PDF [21-Mar-2024]

And: Board-changes (SPR).PDF [21-Mar-2024]

Also, recently: More-strong-drill-hits-across-key-prospects.PDF [20-Mar-2024]

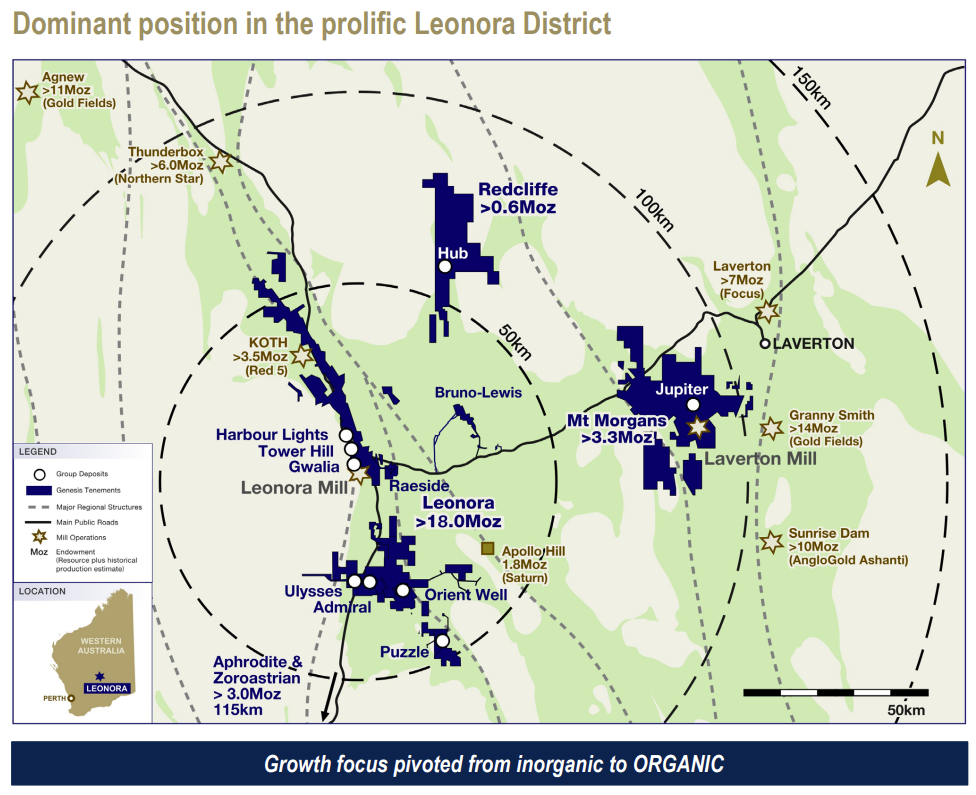

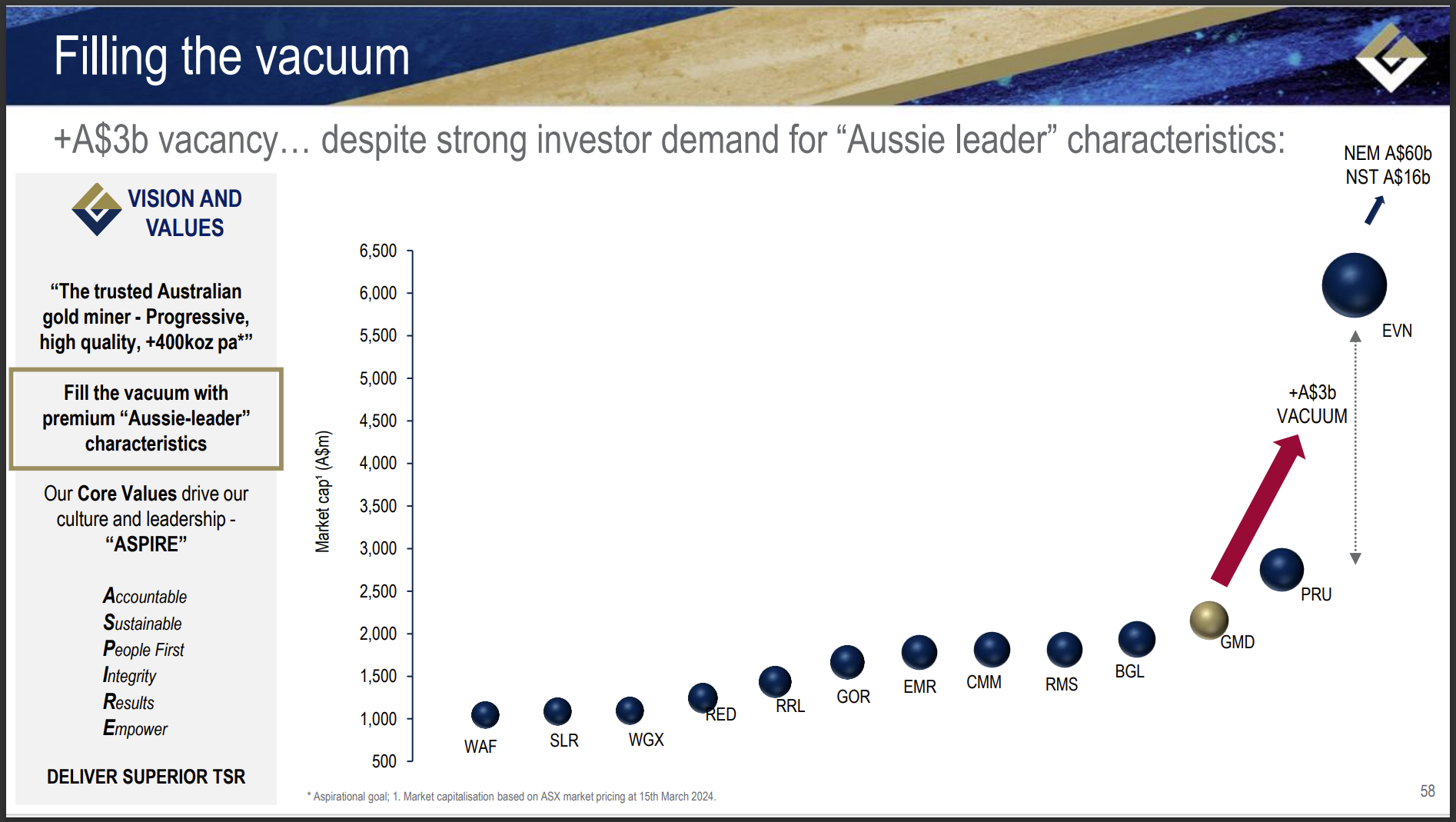

Genesis Minerals (GMD):

Five-year Strategic Plan [68 pages, 21-Mar-2024, 5:09pm]

And: Growth strategy underpinned by robust Reserves [370 pages, 21-Mar-2024, 5:02pm]

Predictive Discovery (PDI):

--- --- ---

Today's MoM poddy:

https://www.youtube.com/watch?v=0RPcQEn8yMc

The Report that Shaved $250 Million from IGO Today | Daily Mining Show - YouTube

Get amongst it!

"We’ve got a big one Money Miners."

"We started the show by dissecting a bearish report written on IGO, before discussing the latest news from Develop (DVP)."

"Next, we pulled apart Sierra Rutile (SRX) in one of the year’s most fascinating M&A stories, then moving to another M&A story that is drawing to a close, we spoke about the Battle for Nyanzaga (ORR, PRU, SVM.t)."

"Meteoric (MEI) & Australian Strategic Materials (ASM) both received non-binding hand outs from the US Export-Import Bank which was worth a chat, before we flew through announcements at Spartan (SPR), Calidus (CAI), Firefly (FFM) and lastly Global Lithium (GL1)."

CHAPTERS

0:00:00 Introduction

0:00:38 More pain to come for IGO?

0:15:47 Develop announce Karora deal

0:23:41 The years most fascinating M&A deal (SRX)

0:34:48 The Battle for Nyanzaga is almost done (ORR, PRU, SVM.t)

0:36:30 MEI & ASM get big government boost

0:40:24 Why the board changes at Spartan?

0:47:11 Calidus rattle the tin

0:52:34 Firefly's copper equivalents

0:53:35 Global Lithium find drill results

-------------------------------

DISCLAIMER

All Money of Mine episodes are for informational purposes only and may contain forward-looking statements that may not eventuate. The co-hosts are not financial advisers and any views expressed are their opinion only. Please do your own research before making any investment decision or alternatively seek advice from a registered financial professional.

-------------------------------

Growth strategy underpinned by robust Reserves

Because their two price-sensitive announcements were both releassed after 5pm this arvo, the market will get to react to those tomorrow morning.

I have posted a straw about this presentation here. [You will likely have to scroll down past my GMD "valuation" to reach that straw if you use that link.]

Disclosure: I hold GMD shares.